Online applications are positioned for an online world. There are few players on the market yet who do much else.Ĥ. I’m not so sure they had much of a choice otherwise. I’m keeping my eye on some of the up and coming online products not reviewed, like Plex for manufacturers and ServiceMax for people in the service industry, as well as bigger players like Intacct and NetSuite. The author’s approach for this book was to focus only on applications for micro-business, small business and invoicing. But most small businesses I know have more industry specific requirements and will not have their needs addressed with these services. Right now, they’re designed to handle the bookkeeping needs of most small businesses, regardless of their industry. End users looking for the ability to significantly customize the applications or implement advanced workflow processes will likely also find themselves disappointed.ģ.

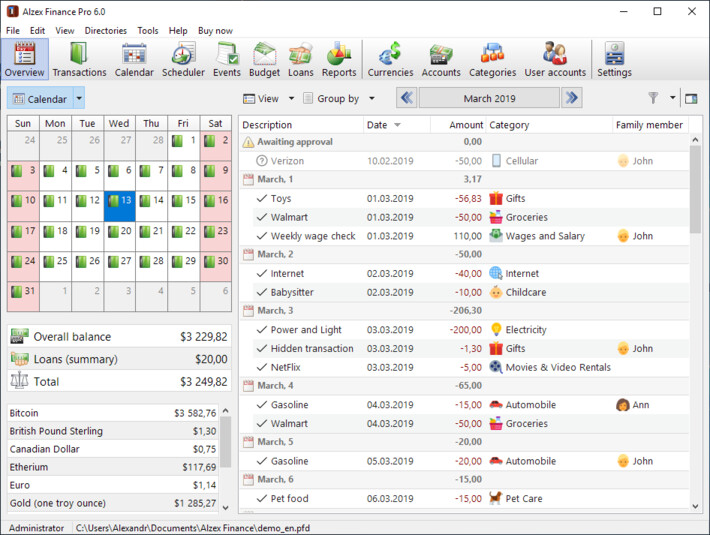

But companies looking for more complex processing such as advanced inventory management, purchase order control, human resources, CRM and detailed fixed asset management are not good candidates for these products. Most do a good job handling the accounting basics, from invoicing to payables management to general ledger postings. The applications reviewed are still immature. As I’ll further describe below these applications mostly lack certain advanced features, have potential data and user limitations and contain less functionality for certain vertical industries.Ģ. Although the benefits are many, the book stresses that there are tradeoffs, including their dependence on a good internet connection and a culture that accepts less control over your data. Online applications are not for everyone. The ebook reviews these cloud accounting applications for micro and small businesses: QuickBooks Online, Xero, Cheqbook, Kashoo, Wave, Zoho Books, and FreshBooks. But with so many threats today many business owners are reluctantly agreeing that their financial data is probably better secured by a cloud provider whose business model is reliant on security than on their own server that’s looked after maybe once a month by their local IT guy. No cloud provider, not even the Department of Defense, can provide 100% security against hackers. Many small business owners are taking notice, particularly because of their benefits.Īnd the benefits are many: access from anywhere, integration with other popular third party cloud applications and banking software, better backup, quicker bug fixes, immediate access to upgrades. Online, or cloud financial applications, are slowly but surely becoming the norm. You were probably, like myself and most small business owners, still trying to get your arms around the cloud and doubting that you would ever entrust your most critical financial data to some outside company. Would you have been interested in a “cloud based” accounting application only a few years ago? Probably not.

The very fact that you’re reading this marks a milestone.

0 kommentar(er)

0 kommentar(er)